Internal Rate of Return - IRR

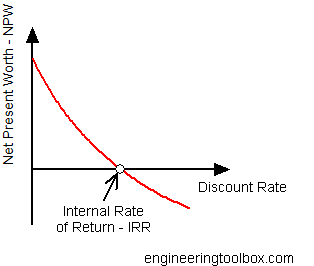

Internal Rate of Return (IRR) - the break-even interest rate.

A primary measure of an investments worth (or value) is based on yield and known as the internal rate of return - IRR .

The internal rate of return can be defined as the break-even interest rate which equals the Net Present Worth - NPW - (Net Present Value) of a project in and out cash flows.

P irr = Fcash_in - Fcash_out

= 0 (1)

where

irr = internal rate of return

Fcash_in = future cash flow in ( discounted)

Fcash_out = future cash flow out ( discounted)

(1) can be expressed as

P irr = F0 / (1 + irr )0 + F1 / (1 + irr )1 + F2 / (1 + irr )2+ .... + Fn / (1 + irr )n = 0 (2)

where

F0..n = cash flow in period 0 to n (positive value for cash flow in - negative value for cash flow out)

For a given cash flow equation (2) can be solved by iteration.

Cash Flow Internal Rate of Return Calculator

- money out - negative values

- money in - positive values

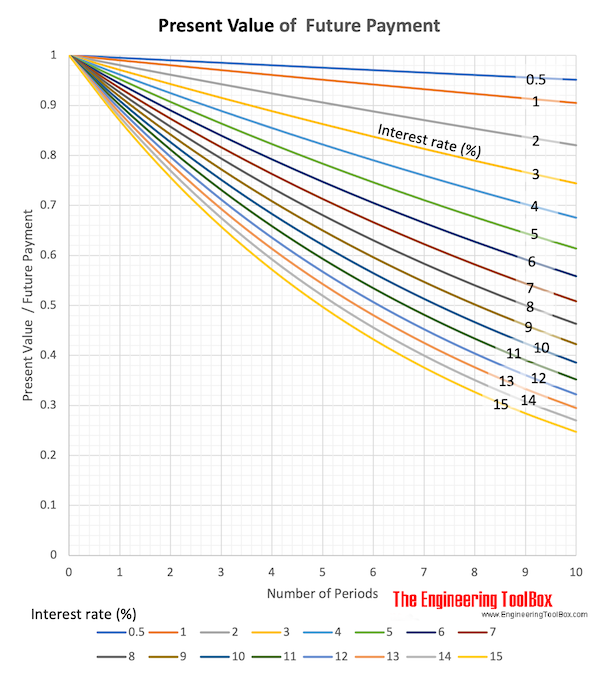

Download and print Present Value of Future Payment chart

Minimum Attractive Rate of Return - MARR

Minimum Attractive Rate of Return - MARR - represents the required or minimum acceptable Internal Rate of Return for a project investment.