Discrete Compounding Cash Flow Formulas

Discrete payments compounding equations and online calculators .

Single Payment

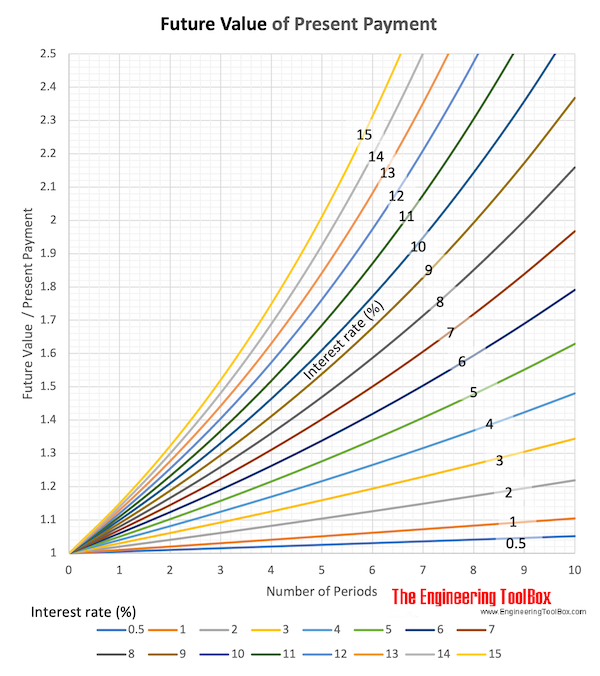

Compound Amount

Converts a single payment (or value) today - to a future value.

F = P (1 + i)n (1)

where

F = future value

P = single payment today

i = interest rate per period

n = number of periods

Download and print Future Value of Present Payment chart

Example - Future Value of an Initial Amount Received Today

An amount of 5000 is received today. Calculate the future value of this amount after 7 years with interest rate 5 %.

The interest rate can be calculated

i = (5 %) / (100 %)

= 0.05

The future value of the amount can be calculated

F = (5000) ((1 + 0.05)7)

= 7036

Future Value - Online Calculator

Note that interest rate in % is used in the calculator - not in the equation.

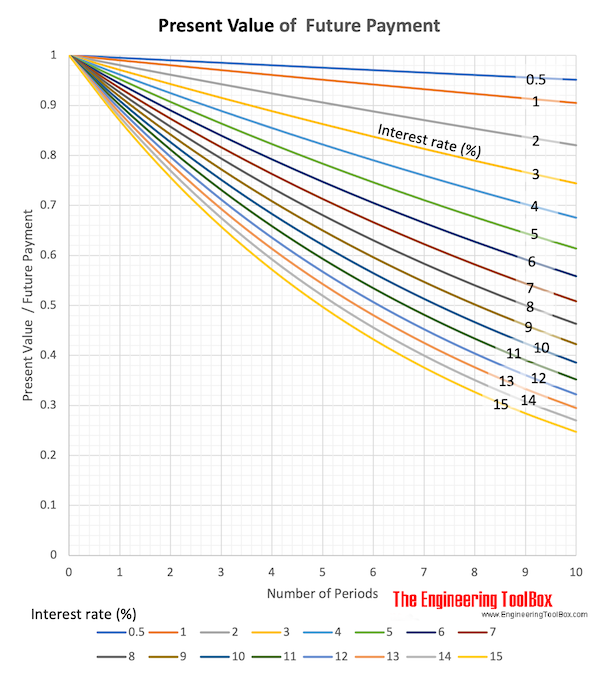

Present Worth (or Value)

Converts a future payment (or value) - to present wort (or value).

P = F (1 + i)-n (2)

where

P = present value

F = single future payment

i = discount rate per period

n = number of periods

Download and print Present Value of Future Payment chart

Example - Present Value of a Future Payment

An payment of 5000 is received after 7 years. Calculate the present worth (or value) of this payment with dicount rate 5 %.

The discount rate can be calculated

i = (5 %) / (100 %)

= 0.05

The present worth of the future payment can be calculated

F = (5000) ((1 + 0.05)-7)

= 3553

Present Value - Online Calculator

Note that discount rate in % is used in the calculator - not in the equation.

Uniform Series

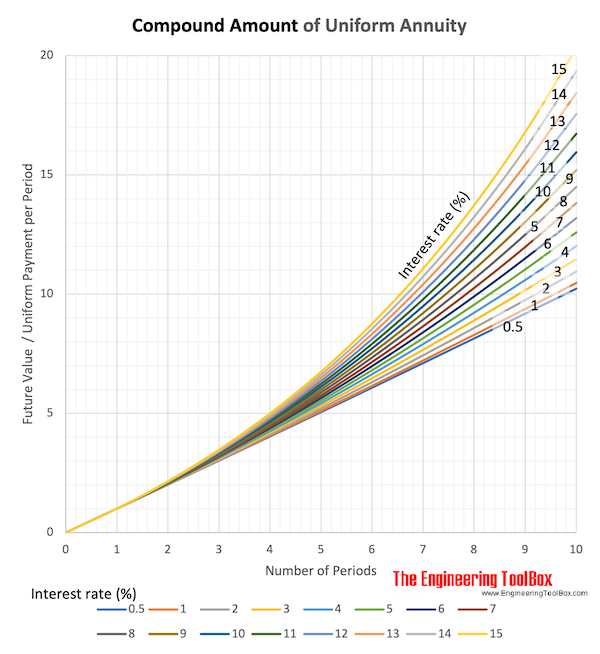

Compound Amount - Annuity

Converts a uniform amount (annuity) - to a future value.

F = A ((1 + i)n - 1) / i (3)

where

F = future value

A = uniform amount per period

i = interest rate

n = numbers of periods

Download and print Compound Ammount of Uniform Annuity chart

Download and print Compound Ammount of Uniform Annuity chart

Example - Present Value of Uniforms Payments

An uniform amount of 5000 is paid every year in 7 years. Calculate the future value of this amount with interest rate 5 %.

The interest rate can be calculated

i = (5 %) / (100 %)

= 0.05

The future value of the annuity can be calculated

F = 5000 ((1 + 0.05)7 - 1) / 0.05

= 40710

Compound Amount - Online Calculator

Note that interest rate ín % is used in the calculator - not in the equation.

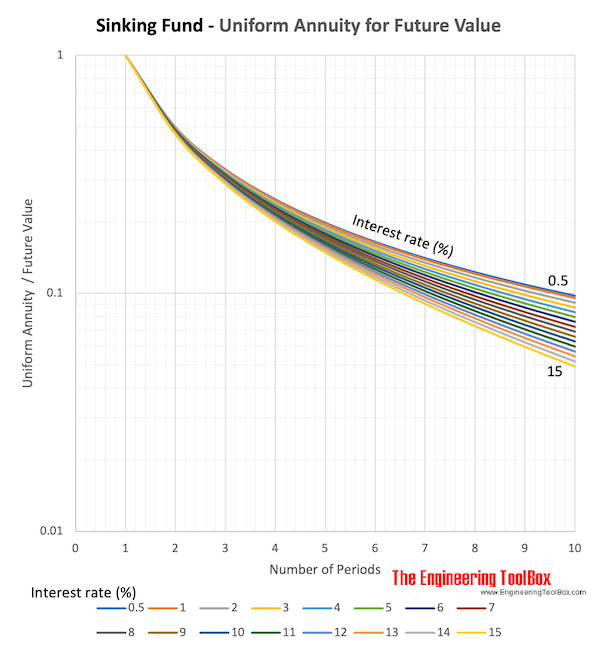

Sinking Fund

Converts a specific future value to uniform amounts (annuities).

A = F i / ((1 + i)n - 1) (4)

where

A = uniform amount per period

F = future value

i = interest rate

n = number of periods

Download and print Sinking Fund - Uniform Annuity to Future Value chart

Example - Uniforms Payments required to reach a Future Value

The future value of a 7 years annuity is 5000 . Calculate the required annuity to reach this value with interest rate 5 % .

The interest rate can be calculated

i = (5 %) / (100 %)

= 0.05

The uniform payments (annuity) can be calculated

A = 5000 (0.05 / ((1 + 0.05)7 - 1))

= 614

Sinking Fund - Online Calculator

Note that interest rate in % is used in the calculator - not in the equation.

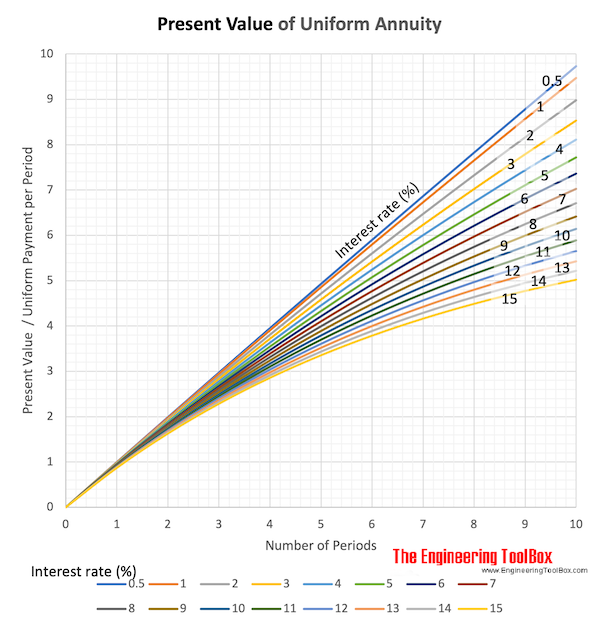

Present Worth

Converts a uniform amount (annuity) - to a present value .

P = A ((1 + i)n - 1) / (i (1 + i)n) (5)

where

P = present value

A = amount per interest period

i = discount rate

n = discount periods

Download and print Present Value of Uniform Annuity chart

Example - Present Value of Uniform Amounts

The uniform amount (annuity) paid from a 7 years project is 5000. Calculate the present value with interest rate 5 %.

The interest rate can be calculated

i = (5 %) / (100 %)

= 0.05

The present value of the uniform amounts can be calculated

P = 5000 ((1 + 0.05)7 - 1) / ( 0.05 (1 + 0.05)7)

= 28932

Present Worth or Value - Online Calculator

Note that discount rate % is used in the calculator - not in the equation.

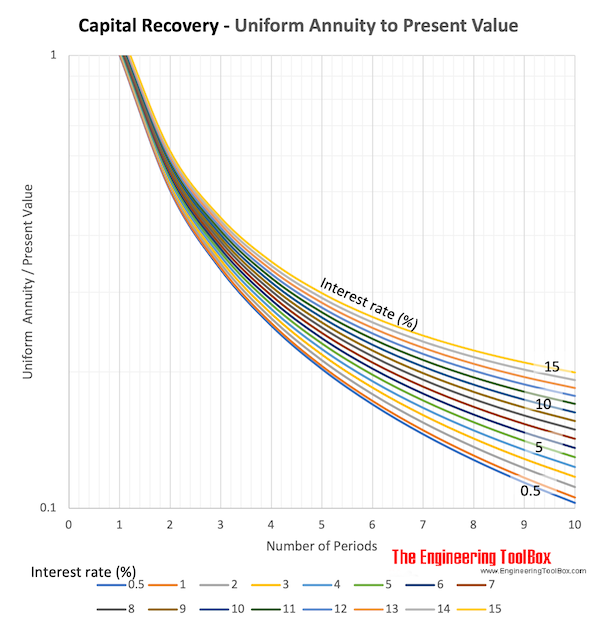

Capital Recovery

Converts a present value - to a uniform amount (annuity).

A = P (i (1 + i)n) / ((1+i)n - 1) (6)

where

P = present value

A = amount per interest period

i = interest rate

n = discount periods

Download and print Capital Recovery - Uniform Annuity to Present Value

Download and print Capital Recovery - Uniform Annuity to Present Value

Capital Recovery - Online Calculator

Note that interest rate in % is used in the calculator - not in the equation.