Perpetuities

An asset providing a fixed cash flow.

A perpetuity is an asset that provides a never ending periodic fixed amount of cash flow.

Endowments and trust funds and long lived assets like oil wells or gas fields can be regarded as a perpetuity.

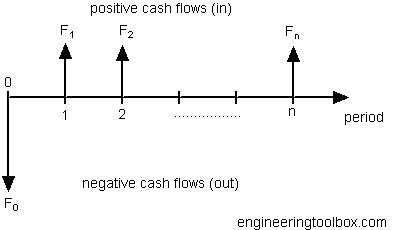

The value of a perpetuity can be calculated as

P = F1 / (1 + i)1 + F2 / (1 + i)2 + F3 / (1 + i)3 + ...... + Fn / (1 + i)n

= F / i (1)

where

P = present value

F = F1 = F2 ... Fn = the fixed amount of cash flow per period

i = discount rate of return (per time period)

Example - The Value of a Company and Net Income

A company is able to deliver a net income every year of 100 . Assuming that this is a perpetuity - a never ending income - the value of this cash flow (and the value of the company) with a discount rate of 10% (i = 0.10) can be calculated to

P = (100) / 0.10

= 1000

Growing Perpetuity

If a cash flow grows in a constant rate the value of the perpetuity can be expressed as

P = F / (i - g) (2)

where

g = growth rate of cash flow (per time period)

Example - The Value of a Growth Company and Net Income

A growth company is able to deliver a net income first year of 200 with a net income growth rate the next years of 3% (g = 0.03) . Assuming that this is a perpetuity - a never ending income - the value of this cash flow (and the value of the company) with a discount rate of 10% (i = 0.10) can be calculated to

P = (100) / (0.10 - 0.03)

= 1429